does nevada tax your retirement

Military retirees can elect either a 40 percent exclusion of military retirement income for seven consecutive tax years or a 15 percent exclusion for all tax years beginning at age 67. You have to pay federal taxes in every state.

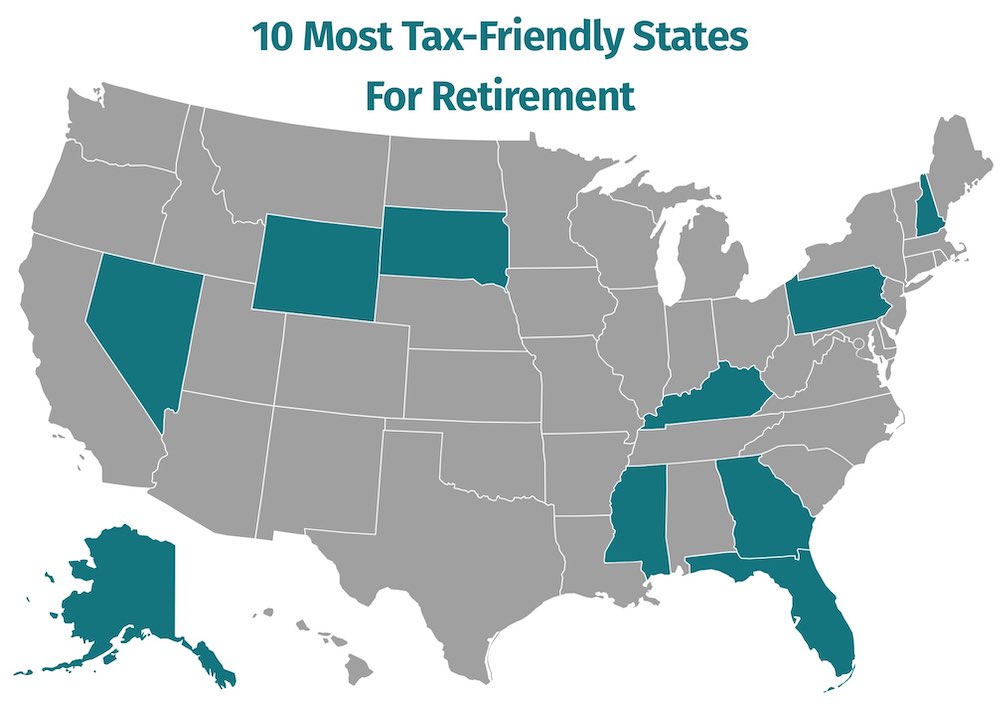

Which Are The Most Tax Friendly States For Retirees 2020 Newretirement

800-742-7474 or Nebraska Tax Department.

. As of the 2021 tax year eight states have no income tax. Those who retire in Nevada dont pay taxes on retirement income as theres no state income tax. This also means pensions and social security are not taxed by the State.

40000 single 60000 joint pension exclusion depending on income level. Since Nevada does not have a state income tax any income from a pension from a 401k from an IRA or from any other retirement account is not taxable. These states are Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming.

To figure out your provisional income begin with your adjusted gross income and then add 50 of your Social Security benefit and all of your tax-exempt interest. 5 tax on interest dividends. What taxes do Nevada residents pay.

Nevada does not tax retirees accounts or pensions. Nevada gasoline tax is 3352 centsgallon. Yes Nevada is a tax-friendly state for retirees.

Withdrawals from retirement accounts are not taxed. Nevada sales tax is less than in California. Nine of those states that dont tax retirement plan income simply have no state income taxes at all.

The remaining three Illinois Mississippi and Pennsylvania dont tax distributions from 401 k plans IRAs or pensions. Thus we crunched the numbers and present a concise yet thorough analysis. While tourists come to Nevada to gamble and experience Las Vegas residents pay no personal income tax and the state offers no corporate tax no franchise tax and no inventory taxThe Silver State does have a 685 sales tax and also collects fees most of them related to those casinos the tourists flock to.

Forty-one states and Washington DC do have a state income tax. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. New Hampshire taxes unearned income such as interest and dividends but it will end the practice as of Jan.

Nevada diesel tax is 2856 centsgallon. If your provisional income is less than 25000 for individual filers or 32000 for joint filers you wont have to pay taxes on your Social Security. However some states dont have state income taxes.

Which states dont tax my 401K social security benefits and military retirement pay. For many people who are considering a financially-based move from California to Nevada an adequate understanding of how tax structures can affect them is important to their decision-making. However if your provisional income falls between.

Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming.

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Retirement Income Best Places To Retire

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

Map Here Are The Best And Worst U S States For Retirement In 2020

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Retirement Retirement Planning

Nevada Retirement Tax Friendliness Smartasset

Top 10 Most Tax Friendly States For Retirement 2021

Retiring These States Won T Tax Your Distributions

Which Are The Most Tax Friendly States For Retirees 2020 Newretirement

37 States That Don T Tax Social Security Benefits The Motley Fool

State By State Guide To Taxes On Retirees Retirement Tax Income Tax

The Best And Worst States For Retirement Ranked Huffpost Life Retirement Best Places To Retire Retirement Community

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

Best Worst States To Retire In 2022 Guide

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies