prince william county real estate tax assessment

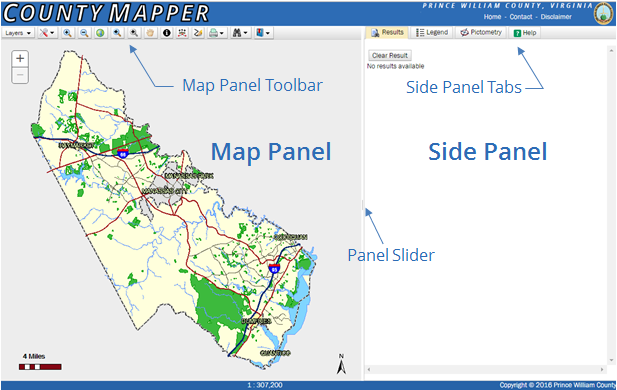

Use both House Number and House Number High fields when searching for range of house numbers. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

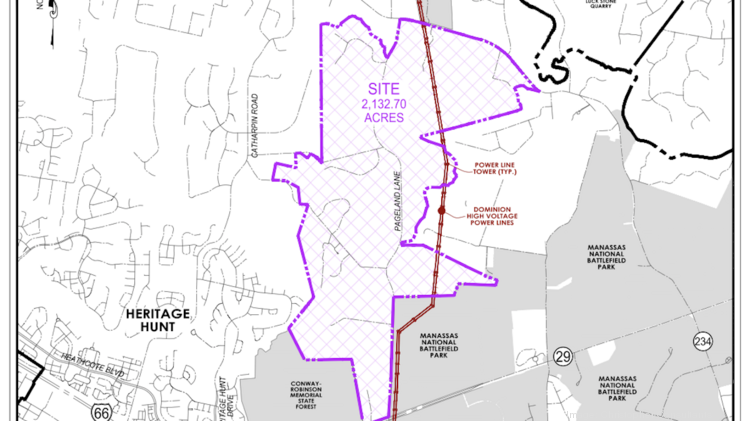

Data Center Opportunity Zone Overlay District Comprehensive Review

Hi the county assesses a land value and an improvements value to get a total value.

. Payment by e-check is a free service. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. If you have questions about this site please email the Real Estate.

00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated. Dial 1-888-2PAY TAX 1-888-272-9829. By creating an account you will have access to balance and account information notifications etc.

Learn all about Prince William County real estate tax. When prompted enter Jurisdiction Code 1036 for Prince William County. If your account numberRPC has less.

Searching by name is not available. This estimation determines how much youll pay. Free Prince William County Treasurer Tax Collector Office Property Records Search.

A convenience fee is added to payments by credit or debit card. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by. Press 1 to pay Personal Property Tax.

Prince William County Virginia Home. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Enter the Tax Account numbers listed on the billing.

See Property Records Tax Titles Owner Info More. What is the property tax rate in Prince William County VA. Press 1 for Personal Property Tax.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Use both House Number and House Number High fields. Press 2 to pay Real Estate Tax.

Search For Title Tax Pre-Foreclosure Info Today. Account numbersRPCs must have 6 characters. Search Any Address 2.

Enter jurisdiction code 1036. Be Your Own Property Detective. Citizens and businesses struggling to pay real.

Business are also assessed a. Due to the low tax rate. Enter the house or property number.

Then they get the assessed value by multiplying the percent of total value assesed currently 100. The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of. Find Out Whats Available.

To make matters worse for residential. Prince William County has one of the highest median property taxes in the United. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

You can contact the. You can pay a bill without logging in using this screen. Personal Property Tax Vehicle License Fee.

In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile homes. In Prince William County Virginia the tax rate is 105 which is substantially above the state average. There is 1 Assessor Office per 225381 people and 1.

Enter the house or property number. All you need is your tax account number and your checkbook or credit card. Press 2 for Real Estate Tax.

Ad Uncover an In-Depth Array of Information on Any Property Nationwide. You may appeal to the Circuit Court of Prince William County within three years of the assessment. Than 6 characters add leading zeros to it.

Find Prince William County residential property records including owner names property tax. If you have not received a tax bill for your property and believe you should have. Our Search Covers City County State Property Records.

There are 2 Assessor Offices in Prince William County Virginia serving a population of 450763 people in an area of 337 square miles. Enter the Account Number listed on the. Prince william county real estate tax assessment Wednesday June 8 2022 Edit.

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Class Specifications Sorted By Classtitle Ascending Prince William County

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County Park Rangers New On Call Number Effective April 1 2022

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Sheriff S Office Wikiwand

Prince William County Sheriff S Office Wikiwand

Prince William Wants To Hike Property Taxes Introduces Meals Tax